Apply for Construction Worker Loan

Construction Worker Loans to Support Your Craft!

Construction Worker Loans to help skilled workers invest in tools, equipment, or personal development.

Home > Construction Worker Loan

Apply for Construction Worker Loan

Enjoy flexible repayment terms with easy monthly installments, designed to support your tool and equipment needs, project costs, or skill development. Empower your construction journey with the financial assistance you deserve.

Easy Eligibility

Basic Eligibility Criteria for Sarmaya Loans

1. Age:

• Minimum: 21 years

• Maximum: 60 years (at the time of loan maturity)

2. Residency:

• Must be a resident of Pakistan.

• Proof of residency required (utility bill, rental agreement, or CNIC with address).

3. Income Source:

• Employed or self-employed individuals.

• Minimum monthly income: PKR 50,000

• Income proof required (salary slip, bank statement, or business proof).

4. CNIC:

• Valid Computerized National Identity Card (CNIC).

5. Bank Account:

• Active personal bank account in the applicant’s name for loan disbursement.

6. Credit History:

• No history of defaults or negative credit behavior (if applicable).

7. Guarantor (if required):

• A trusted guarantor needed

8. Other Documents:

• Completed loan application form.

Flexible Repayment

Flexible Repayment Options

To make repayment easy and accessible for borrowers:

Multiple Payment Channels

• Through Bank:

• Borrowers can transfer loan installments directly to Sarmaya’s bank account via online banking, ATM, or branch deposit.

• Via Portal/App:

• Sarmaya Loan App allows customers to view their repayment schedule and make payments using e-wallets, debit/credit cards, or mobile banking.

• Cash Collection Service:

• Borrowers can request a cash collection service by calling Sarmaya’s helpline. A designated officer will visit the borrower’s location to collect the repayment.

How It Works?

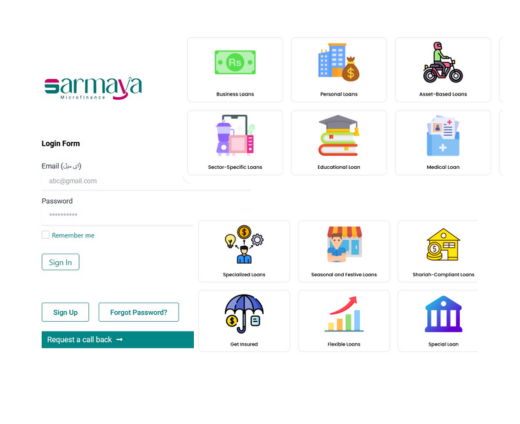

- Explore Loan Options

Select the loan type that fits your requirements:- Business Loans: Financing for shopkeepers, startups, traders, or equipment purchases.

- Personal Loans: For emergencies, education, weddings, or salary advances.

- Specialized Loans: Tailored solutions for women entrepreneurs, youth, or travelers.

- Shariah-Compliant Loans: Ethical financing based on Islamic principles.

- Register or Log In

- New users: Create an account using your CNIC, phone number, and email.

- Existing users: Log in to view your account and application status.

- Submit Your Application

- Provide basic details, loan amount, and purpose.

- Upload required documents, such as:

- CNIC (front and back).

- Recent utility bill.

- Income proof (e.g., salary slip or bank statement).

- Approval & Disbursement

- Your application will be reviewed within 24-48 hours.

- Upon approval, funds will be disbursed directly to your bank account, Easypaisa, or JazzCash wallet.

- Repayment Made Easy

- View your repayment schedule on your dashboard.

- Pay through bank transfer, Easypaisa, or JazzCash.

Why Sarmaya?

Streamlined Process

No complicated paperwork or long waits—apply easily from anywhere and get approval within hours.Flexible Terms to Fit Your Cash Flow

We understand that every business is unique, so we customize repayment schedules to align with your income cycles.Quick Access to Capital

Once approved, your funds are quickly disbursed, so you can seize business opportunities without delay.Dedicated Customer Support

Our team is here to assist you at every step—from application to repayment—ensuring a smooth, hassle-free experience.- Shariah-Compliant Choices: Ethical financing options available.

What's Next?

• Review loan details on the dashboard after logging in.

• Track application progress and repayment schedules.

• Access customer support anytime for assistance.

Sarmaya Microfinance Made it Easy

Let us help you achieve your financial goals today!

Your Personal Loan,

Your Way!

Avail our personal loans through your preferred platform and enjoy unmatched convenience at your fingertips…

- General

Frequently Asked Questions

What is Sarmaya Microfinance?

Sarmaya Microfinance provides accessible and convenient loan solutions for individuals and businesses in Pakistan.

Who can apply for a loan at Sarmaya Microfinance?

Any Pakistani resident aged 18 or older with a valid CNIC can apply, subject to income and repayment capability.

What types of loans does Sarmaya offer?

We offer Business Loans, Personal Loans, and Specialized Loans tailored to meet your specific needs.

How do I apply for a loan?

- Sign up on our app or website with your CNIC and phone number.

- Select a loan type and complete the application with required details and documents.

What documents are required to apply for a loan?

You need to upload a clear photo of your CNIC, a recent utility bill, and proof of income (e.g., salary slip, bank statement).

How long does the loan approval process take?

Loan applications are reviewed within 24-48 hours after submission.

How will I know if my loan is approved?

You will receive an approval notification via SMS, email, and on your app or website dashboard.

How will I receive the loan amount?

Loan disbursements are made directly to your bank account, Zindagi wallet, Easypaisa, or JazzCash wallet.

What is the repayment process?

- View your repayment schedule on the app.

- Receive reminders for due payments.

- Pay installments through bank transfers, Easypaisa, or JazzCash

What happens if I miss a repayment?

In case of missed payments, you may incur late fees, and it could impact your credit score and future borrowing eligibility.

Can I apply for another loan while repaying my current one?

You can apply for a new loan after clearing your current one or as per eligibility criteria for multiple loans.

How can I contact Sarmaya for support?

You can reach our customer support team via email, phone, or the live chat feature on our app or website.

Is my information secure with Sarmaya?

Yes, we prioritize your privacy and use advanced encryption to ensure your personal and financial data is protected.

Are there any hidden charges?

No, all fees and charges, including the processing fee and interest rate, are transparently disclosed during the application process.

Can I prepay my loan?

Yes, you can prepay your loan at any time. Contact our support team to understand any applicable terms for prepayment.