Apply for Business Loan

Business Loans

Looking to stock up your expand your business? Sarmaya Microfinance is here to provide the funds you need to grow!

Home > Business Loans

Business Loan Products

Loans for small shopkeepers to purchase inventory or expand their businesses.

Financing for new entrepreneurs with feasible business plans.

Short-term loans for traders to manage working capital and trade finance needs.

For purchasing tools, machinery, or equipment for business use.

Sarmaya Microfinance Made it Easy

Let us help you achieve your financial goals today!

Your Personal Loan,

Your Way!

Avail our personal loans through your preferred platform and enjoy unmatched convenience at your fingertips…

- General

Frequently Asked Questions

What is Sarmaya Microfinance?

Sarmaya Microfinance provides accessible and convenient loan solutions for individuals and businesses in Pakistan.

Who can apply for a loan at Sarmaya Microfinance?

Any Pakistani resident aged 18 or older with a valid CNIC can apply, subject to income and repayment capability.

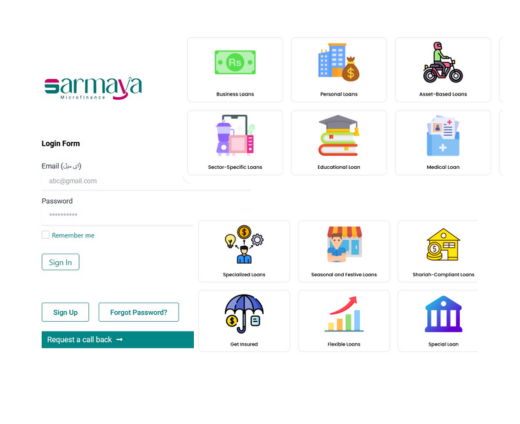

What types of loans does Sarmaya offer?

We offer Business Loans, Personal Loans, and Specialized Loans tailored to meet your specific needs.

How do I apply for a loan?

- Sign up on our app or website with your CNIC and phone number.

- Select a loan type and complete the application with required details and documents.

What documents are required to apply for a loan?

You need to upload a clear photo of your CNIC, a recent utility bill, and proof of income (e.g., salary slip, bank statement).

How long does the loan approval process take?

Loan applications are reviewed within 24-48 hours after submission.

How will I know if my loan is approved?

You will receive an approval notification via SMS, email, and on your app or website dashboard.

How will I receive the loan amount?

Loan disbursements are made directly to your bank account, Zindagi wallet, Easypaisa, or JazzCash wallet.

What is the repayment process?

- View your repayment schedule on the app.

- Receive reminders for due payments.

- Pay installments through bank transfers, Easypaisa, or JazzCash

What happens if I miss a repayment?

In case of missed payments, you may incur late fees, and it could impact your credit score and future borrowing eligibility.

Can I apply for another loan while repaying my current one?

You can apply for a new loan after clearing your current one or as per eligibility criteria for multiple loans.

How can I contact Sarmaya for support?

You can reach our customer support team via email, phone, or the live chat feature on our app or website.

Is my information secure with Sarmaya?

Yes, we prioritize your privacy and use advanced encryption to ensure your personal and financial data is protected.

Are there any hidden charges?

No, all fees and charges, including the processing fee and interest rate, are transparently disclosed during the application process.

Can I prepay my loan?

Yes, you can prepay your loan at any time. Contact our support team to understand any applicable terms for prepayment.