Grievance Redressal Mechanism

Home > Grievance Redressal Mechanism

Grievance Redressal Mechanism

At Sarmaya Microfinance, we value our customers and are committed to addressing their concerns in a timely and effective manner. Our Grievance Redressal Mechanism is designed to ensure transparency, fairness, and efficiency in resolving complaints.

How to Lodge a Complaint

Customers can lodge their complaints through the following channels:

- Online Complaint System:

- Visit our website and access the Online Complaint Form in the “Contact Us” section.

- Fill out the required details and submit your complaint. You will receive a tracking number to monitor your complaint status.

- Email:

- Send an email detailing your grievance to complaints@sarmayamf.com.

- Phone:

- Call our Grievance Officer at +92 323 5469280 during office hours (9 AM – 5 PM, Monday to Friday).

- In-Person: Visit our office at the following address: Sarmaya Microfinance Technology Park, I-9, Islamabad

Grievance Officer Contact Details

- Grievance Officer: Mr. Asif Yousaf

- Email: grievance@sarmayamf.com

- Phone: +92 323 5469280

Resolution Timeline

- All grievances will be acknowledged within 24 hours of receipt.

- Our Grievance Officer will strive to resolve complaints within 5 working days.

- In cases requiring further investigation, customers will be informed of the expected resolution timeline.

Monitoring & Updates

- Customers can track the status of their complaints using the tracking number provided via the

Online Complaint System

. - Regular updates will be shared with the complainant until the matter is resolved

Escalation Process

If your grievance is not resolved to your satisfaction, you may escalate it by emailing our Compliance Department at care@sarmayamf.com.

We are committed to improving our services and appreciate your feedback to serve you better.

Our Values

- Customer-Centricity: We place our customers at the heart of everything we do, delivering personalized and effective financial solutions.

- Innovation: We embrace cutting-edge technology to offer smarter, faster, and more efficient financial services.

- Integrity: We are committed to transparency, honesty, and ethical practices in all our dealings.

- Inclusivity: We strive to ensure financial services are accessible to everyone, regardless of their background or location.

- Empowerment: We believe in providing the tools and resources for individuals and businesses to take control of their financial futures.

Why Choose Sarmaya Microfinance

- Fast & Easy Access: Get loans and financial services instantly, directly from your smartphone—no paperwork, no waiting.

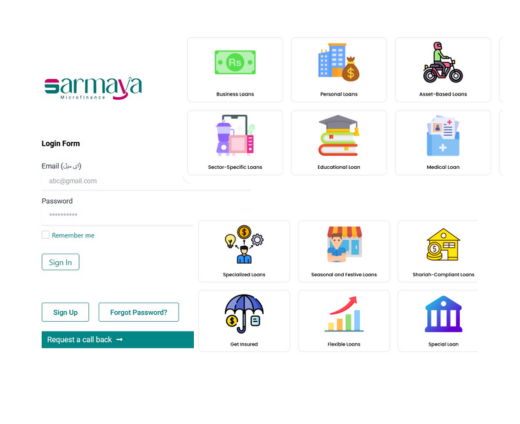

- Flexible Loan Products: Tailored financial solutions designed to suit your needs, whether for personal, business, or emergency purposes.

- Secure & Reliable: Our technology ensures that your data and transactions are safe, private, and reliable.

- Nationwide Reach: We bring financial inclusion to every corner of Pakistan, reaching customers wherever they are.